Ricky is taking out a personal loan, a financial move that can be both empowering and daunting. Whether it’s for consolidating debt, making a major purchase, or covering unexpected expenses, understanding the ins and outs of personal loans is crucial.

This guide will provide Ricky and anyone considering a personal loan with the knowledge and insights to make an informed decision.

Before taking the plunge, Ricky should carefully consider his financial situation, loan options, and potential alternatives. Factors such as interest rates, loan terms, and repayment plans can significantly impact his financial well-being. Comparing different loan options and exploring alternatives like credit cards or home equity loans will help Ricky find the best fit for his needs.

Introduction: Ricky Is Taking Out A Personal Loan

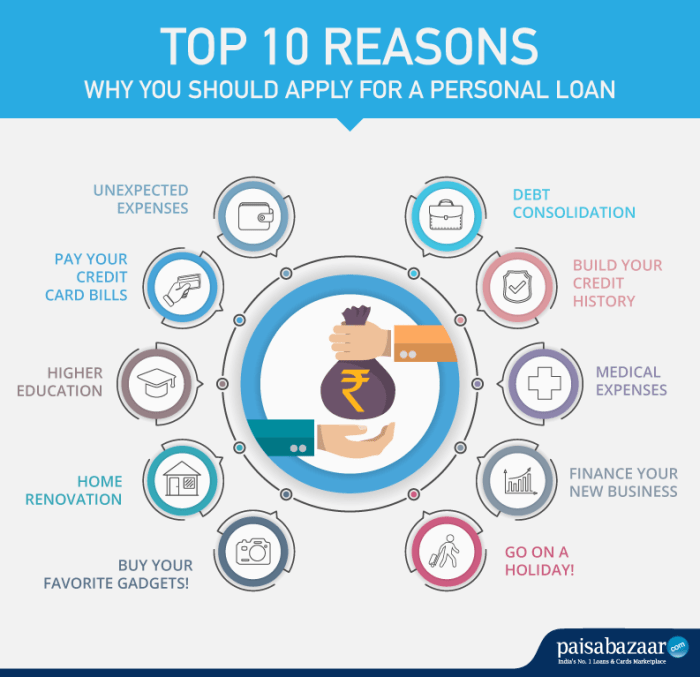

Personal loans are a type of financial product that allows individuals to borrow money from a lender for personal expenses. These loans can be used for a variety of purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses.

Ricky’s Situation

Ricky is considering taking out a personal loan. He is considering this option because he has recently had some unexpected expenses that have put a strain on his finances. He is hoping that a personal loan will help him to consolidate his debt and get his finances back on track.

Factors to Consider

There are several factors that Ricky should consider before taking out a personal loan. These factors include:

- Interest rates

- Loan terms

- Repayment plans

Ricky should carefully consider all of these factors before making a decision about whether or not to take out a personal loan.

Loan Options

There are several different types of personal loans available to Ricky. These types include:

- Secured loans

- Unsecured loans

- Credit union loans

Each type of loan has its own advantages and disadvantages. Ricky should carefully consider all of these options before making a decision about which type of loan to apply for.

Application Process

The application process for a personal loan typically involves submitting an application, providing financial information, and undergoing a credit check. Ricky should be prepared to provide accurate and complete information on the loan application. This information will be used to determine whether or not Ricky is approved for a loan and what interest rate he will be offered.

Alternatives to Personal Loans

There are several alternatives to personal loans that Ricky might consider. These alternatives include:

- Credit cards

- Home equity loans

- Peer-to-peer lending

Each of these alternatives has its own advantages and disadvantages. Ricky should carefully consider all of these options before making a decision about which option is best for him.

Q&A

What is a personal loan?

A personal loan is a sum of money borrowed from a lender for personal expenses, typically unsecured and repaid in monthly installments over a fixed term.

What are the common reasons for taking out a personal loan?

Common reasons include debt consolidation, making large purchases, covering unexpected expenses, home renovations, and medical bills.

What factors should I consider before taking out a personal loan?

Interest rates, loan terms, repayment plans, credit score, debt-to-income ratio, and overall financial situation.

What are the different types of personal loans available?

Secured loans (backed by collateral), unsecured loans (based on creditworthiness), credit union loans, and peer-to-peer lending.