Calculating your paycheck salary worksheet 1 answer key – Welcome to our comprehensive guide on calculating your paycheck salary. This guide will provide you with all the information you need to understand how your paycheck is calculated, including a detailed answer key to help you with any questions you may have.

Whether you’re a new employee or just want to learn more about your finances, this guide is for you.

In this guide, we’ll cover everything from understanding your gross and net pay to calculating deductions and withholdings. We’ll also provide you with tips on how to customize your paycheck calculation worksheet to meet your individual needs.

Calculating Your Paycheck: A Step-by-Step Guide

Calculating your paycheck accurately is crucial for financial planning and budgeting. This comprehensive guide will provide a step-by-step walkthrough of the process, covering income calculation, deductions, net pay determination, and advanced considerations.

1. Paycheck Calculation Worksheet Overview

A paycheck calculation worksheet is a tool that simplifies the process of calculating your paycheck. It typically includes sections for gross income, deductions, and net pay, along with relevant formulas and calculations.

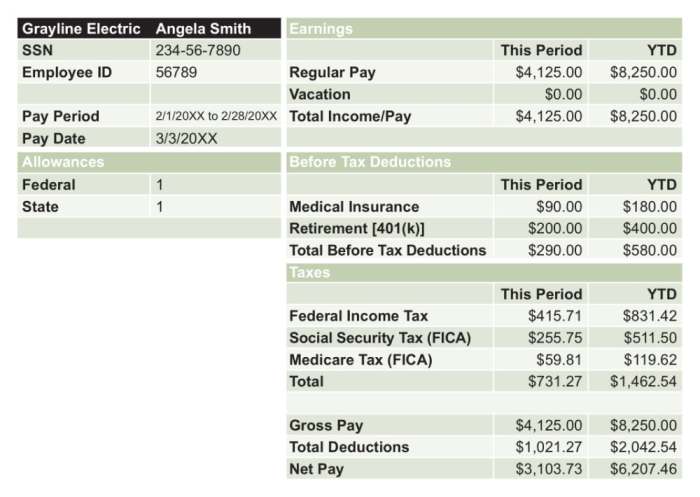

2. Income Calculation, Calculating your paycheck salary worksheet 1 answer key

Gross income refers to your total earnings before any deductions are taken. It includes regular pay, overtime pay, bonuses, commissions, and other forms of compensation.

To calculate gross income, add up all sources of income received during the pay period.

3. Deductions from Gross Income

Deductions reduce your gross income to determine your net pay. Common deductions include:

- Taxes (federal, state, local)

- Insurance premiums (health, dental, vision)

- Retirement contributions (401(k), IRA)

- Union dues

4. Net Pay Calculation

Net pay is the amount of money you receive after all deductions have been subtracted from your gross income.

To calculate net pay, use the following formula:

Net Pay = Gross Income

Deductions

5. Worksheet Design and Customization

When designing a paycheck calculation worksheet, consider:

- Clarity and simplicity

- Inclusion of relevant formulas

- Customization options to accommodate individual needs

Digital worksheets or apps offer convenience and automation.

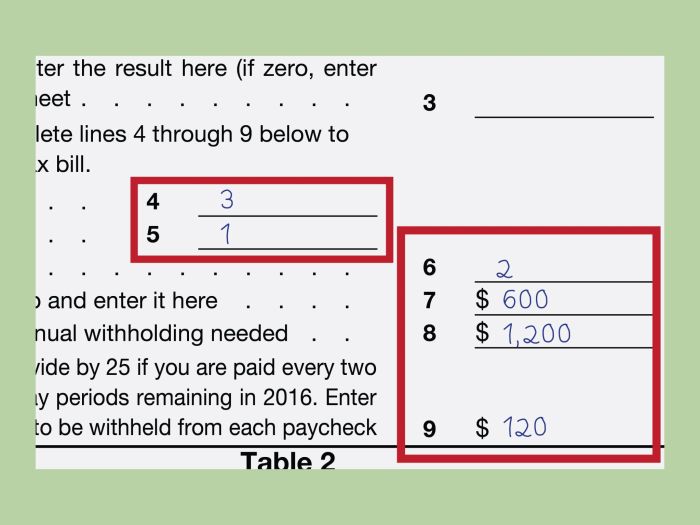

6. Advanced Considerations

Additional factors that may affect paycheck calculations include:

- Overtime pay and bonuses

- Commissions and tips

- Tax laws and regulations

Staying informed about these factors is essential for accurate paycheck calculations.

FAQ Compilation: Calculating Your Paycheck Salary Worksheet 1 Answer Key

What is gross pay?

Gross pay is the total amount of money you earn before any deductions are taken out.

What is net pay?

Net pay is the amount of money you receive after all deductions have been taken out.

What are deductions?

Deductions are amounts of money that are taken out of your paycheck before you receive it. Common deductions include taxes, insurance premiums, and retirement contributions.

What are withholdings?

Withholdings are amounts of money that are taken out of your paycheck and sent to the government to pay for taxes.